Latest Inventory & Offers

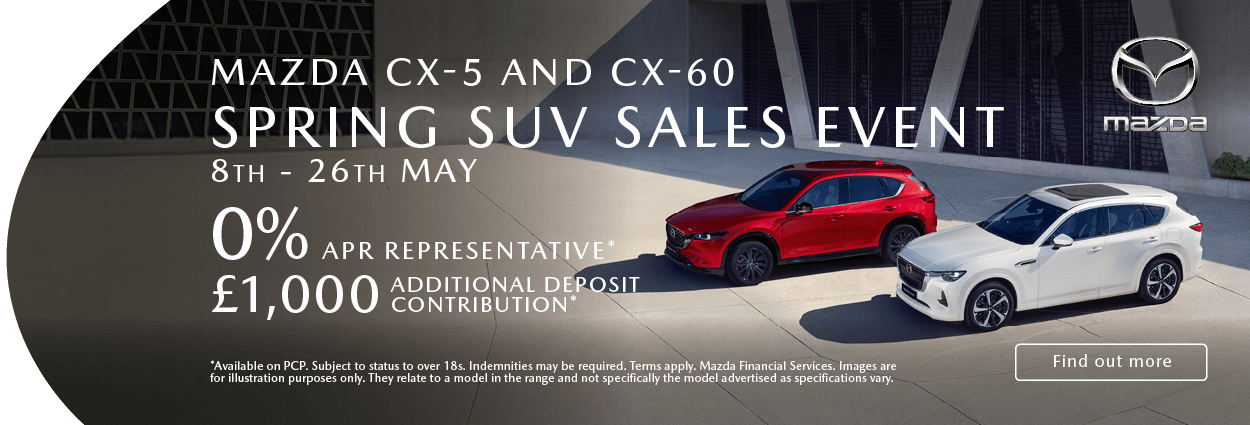

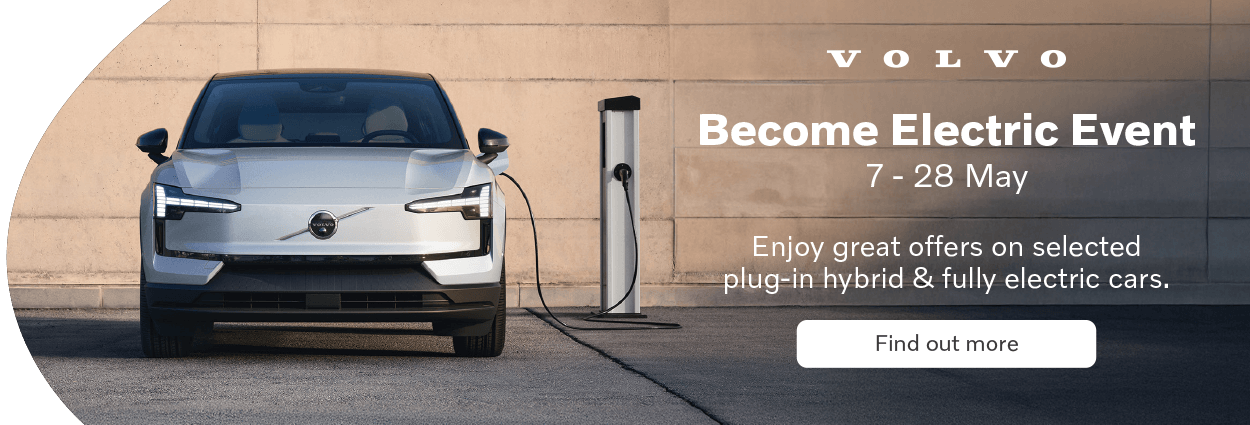

Make a great saving on your next vehicle

Recently Reduced Vehicles

All Reduced VehiclesEx-Demo Cars

All Ex-Demo VehiclesNew Vehicles In Stock

All In-Stock New VehiclesProducts & Services

Find what you need right here

Browse Manufacturers

Choose from 29 Vehicle Brands

Latest Articles

Keep up to date with our blog

Representative Example

This represents an average of the deals that our customers receive on other vehicles

We are a credit broker and a lender. We can introduce you to a limited number of lenders and their finance products. We will provide details of products available, but no advice or recommendation will be made. You must decide whether the finance product is right for you. We do not charge you a fee for our services. Lenders will pay commission to us (either a fixed fee or a fixed percentage of the amount you borrow) for introducing you to them, this may be calculated in reference to a variable factor such as (but not limited to) the vehicle age, your credit score and the amount you are borrowing. Different lenders may pay different commissions for such introductions.