GET TO KNOW MORE ABOUT PCP CAR FINANCE

What is PCP Car Finance?

PCP, or Personal Contract Purchase, is a type of loan and is one of the most popular car finance options available, mainly due to it being the most flexible.

PCP finance not only gives you an opportunity to have lower monthly payments compared to the likes of Hire Purchase (HP), but also allows you multiple options at the end of your agreement.

There are a few components to how a Personal Contract Purchase agreement works, which may seem complicated; however, when broken down, it can be fairly easy to understand - so let’s get started…

Representative Example

This represents an average of the deals that our customers receive on other vehicles

We are a credit broker and a lender. We can introduce you to a limited number of lenders and their finance products. We will provide details of products available, but no advice or recommendation will be made. You must decide whether the finance product is right for you. We do not charge you a fee for our services. Lenders will pay commission to us (either a fixed fee or a fixed percentage of the amount you borrow) for introducing you to them, this may be calculated in reference to a variable factor such as (but not limited to) the vehicle age, your credit score and the amount you are borrowing. Different lenders may pay different commissions for such introductions. Offers available to everyone over the age of 18, subject to credit approval.

How does PCP finance work?

There will be certain terms to agree to, however each can be adjusted to ensure that you get the best PCP car deal to suit you.

Deposit – as with most finance agreements, there is usually a deposit to be paid; while you’re not forced to have one, it is something that will help bring your monthly payments down, as it will reduce the overall cost of the finance.

Term – again, a familiar aspect of financing a car, choosing the length of your term is important, as a shorter term will increase your monthly payments, while a longer term will keep them lower. PCP car deals typically last between 36-48 months.

Annual Mileage – you will need to agree on an annual mileage for the length of the agreement. Again, this will have an impact on how much you pay monthly – fewer annual miles bring the payments down, while more miles per year will increase them.

Excess Mileage Charge - additionally, you will be charged on a per-mile basis for every mile you go over the total mileage for the contract, usually by a few pence per mile. This is only applicable if you plan to hand the vehicle back when the contract is over.

GMFV – This is the optional final payment for the vehicle which, when paid, gives you full ownership of the car.

How does PCP work at the end of the term?

There are three core choices available to you at the end of a Personal Contract Purchase agreement:

Personal Contract Purchase Example:

Step by Step Guide to PCP Car Finance

We make car Personal Contract Purchase finance easy with the help of our dedicated in-house team. Just follow these simple steps.

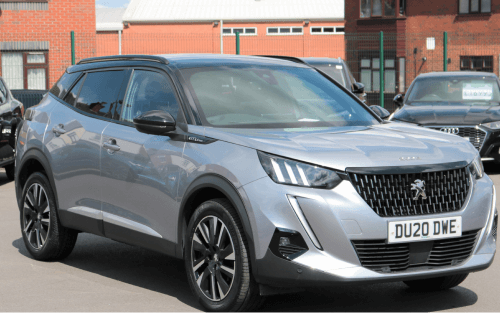

1. Find the Right Car

Personal Contract Purchase agreements are available for both new and used cars. You will find a PCP finance calculator on most used cars for sale. Simply, adjust the deposit, mileage and term to work out the best deal for you.

2. Check Your Eligibility

You can check your overall eligibility for car finance by filling out our online form. Since it's merely a soft search, your credit rating won't be impacted by the outcome.

3. Get Pre-Approved

Get pre-approved for Personal Contract Purchase car finance with our assistance. A member of our finance team will be in touch to walk you through the remaining steps of your application.

4. Dealer Appointment

Our team will assist you in selecting your ideal car and also schedule an appointment for you at one of our dealerships to complete your purchase.

Car PCP Calculator

Our PCP finance calculator is the perfect tool to help calculate PCP finance for used cars. You’ll find that most of our pre-owned vehicles feature our finance calculator, which does most of the leg work to give you a clear picture of how much the vehicle in question might cost.

Your PCP finance package can be tailored to suit you. Simply select your credit rating, deposit and term, followed by your preferred annual mileage.

Based on that information, our Personal Contract Purchase calculator can show you the monthly payments for the car, as well as the GMFV.

While the figures are not a quote or a full offer of finance, you can get in touch with the dealership regarding your PCP car calculation; from there, the dealer will be able to work towards a full quote based on your needs and status.

Personal Contract Purchase Car Finance Is it right for you?

For some, car PCP deals work perfectly for their flexible lifestyle, but for others, they prefer something a little more straightforward.

Personal Contract Purchase financing can be a suitable option if you like to switch cars every few years and don’t mind the restrictions that come with it, such as limits on mileage and potentially having to pay for damage above simple wear and tear.

However, if you’d like to keep a car at the end of an agreement, Hire Purchase may be a better choice - while monthly payments will tend to be higher, there's no large final payment to make the car yours.

Whether having a car on PCP finance is worth it to you, really depends on your preferences and circumstances.

Personal Contract Purchase Advantages and Disadvantages

What to ask when buying a car on PCP

You can be sure you are purchasing from a reputable dealer if you are looking for Personal Contract Purchase deals with Stoneacre.

However, to ensure you are aware of all the pros and cons of your car finance PCP agreement, it's a good idea to get a full understanding of the contract.

New Car PCP Deals

A great deal of new cars are financed on a PCP agreement, and so manufacturers are keen to offer competitive offers when it comes to PCP finance.

As a result, the best PCP deals you'll find will be on brand-new cars, which can offer incentives such as:

- Deposit contributions

- Free servicing

- Low customer deposits

Manufacturers will look to offer low deposit offers when financing through Personal Contract Purchase, meaning they can help those without a part exchange get an affordable new car.