Car Finance Companies & Lenders

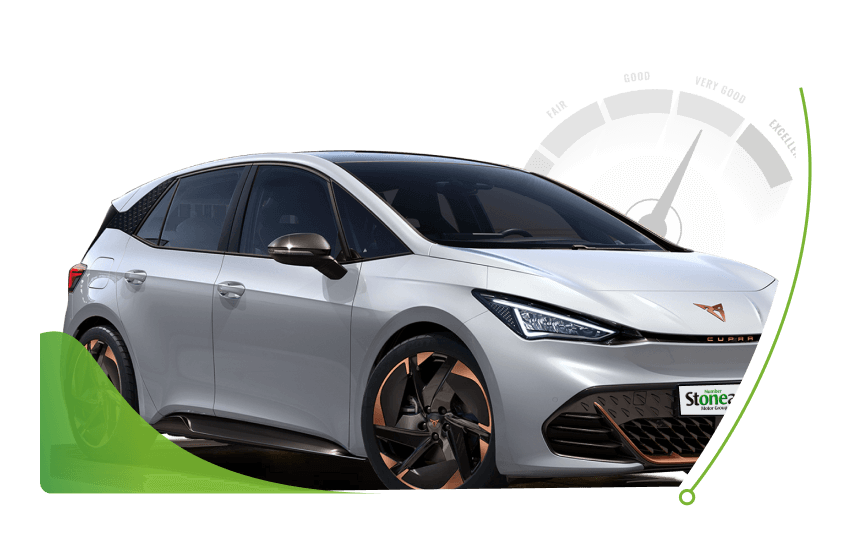

Looking for car finance? At Stoneacre, we've partnered with some of the best car finance companies in the UK to help you get behind the wheel of your dream car.

Our extensive lender network means we can match you with the right finance solution.

With a 2-in-3 acceptance rate, our finance eligibility checker will find you suitable lenders, without affecting your credit score.

Representative Example

This represents an average of the deals that our customers receive on other vehicles

We are a credit broker and a lender. We can introduce you to a limited number of lenders and their finance products. We will provide details of products available, but no advice or recommendation will be made. You must decide whether the finance product is right for you. We do not charge you a fee for our services. Lenders will pay commission to us (either a fixed fee or a fixed percentage of the amount you borrow) for introducing you to them, this may be calculated in reference to a variable factor such as (but not limited to) the vehicle age, your credit score and the amount you are borrowing. Different lenders may pay different commissions for such introductions. Offers available to everyone over the age of 18, subject to credit approval.

List of Car Finance Companies UK

Here are just a few of our car finance lenders, find out more about what each one offers.

What is a car finance broker?

Car finance brokers are a go-between for lenders and customers. As a car finance broker, Stoneacre works with several car financing companies to connect our customers to the most suitable lenders. We handle the process of finding the right finance solution, saving you time and improving your chances of approval.

What is a car finance lender?

Car finance lenders provide financial support for individuals or businesses looking to acquire vehicles. We've partnered with some of the best car finance companies and lenders in the UK, so our customers can secure car finance, even those in sensitive situations. Our selection of specialist lenders can help you, whether you have good credit or are working to rebuild your credit history.

What do car finance companies check?

Car finance companies check several things before lending money for a car purchase. They review your credit score to assess repayment history, verify income for affordability, and consider your down payment or deposit for a car. They will also look at the length of term and vehicle details to understand the level of risk involved.

Our car finance eligibility checker only performs a 'soft search' that's invisible to lenders and won't impact your credit score. If you decide to proceed with a full application, the lender may then perform a hard credit check as part of their final decision.

What types of car finance do you offer?

The car finance companies we work with facilitate a range of different finance options, from a Hire Purchase (HP) plan that provides fixed monthly payments, to a Personal Contract Purchase (PCP) plan that offers more flexibility at the end of your contract.

Our specialist lenders can provide credit for customers with a poor credit history or no credit history at all. For example, new drivers may prefer a black box for payment reminders. Whatever your situation, we can help you find a finance solution that works for you.

See our car finance guide for more information about the finance options we offer.