These days, the majority of people purchase a car using finance - but where does that put you in regards to vehicle ownership?

Well, this is where the discussion of being a Registered Keeper vs the Legal Owner comes into play.

Difference between a Registered Keeper and Legal Owner

You are the registered keeper of a vehicle if you are still making payments on a loan. Generally, the registered keeper of the vehicle must be the one making the payments.

Meanwhile, the finance company is the actual legal owner of the car until the full balance on the agreement has been paid.

Until you acquire complete ownership, all the paperwork that comes with a financed vehicle, such as your V5C registration papers (otherwise known as the logbook), will state that you are the registered keeper of the car.

Only when the vehicle is completely paid for will you then become the owner.

If I have a car on finance, who owns the car?

There are a couple of primary finance options that you can choose to help buy your car:

Meanwhile, the finance company is the actual legal owner of the car until the full balance on the agreement has been paid.

- Hire Purchase (HP)

- Personal Contract Purchase (PCP)

If you are interested in leasing a car, however, then it's likely you've come across Personal Contract Hire (PCH), which works a little differently to the two above.

Elsewhere, there's always the classic method of financing a car: a Personal Loan.

Let's get into the details on each to see where you'd stand..

Understanding Car Ownership Across Finance Types

Can you change the name on a car finance agreement?

You won't be able to change the name on the agreement until after you have made all the payments, as the car belongs to the finance company until then.

However, if you find that you are unable to make payments, you can hand the car back to the finance company as they are the legal owners.

Depending on how far into the agreement you are, or if you have missed any payments, it could be that you still owe the finance company further amounts.

You would need to check your terms and conditions and get in touch with your provider to see how they can help.

Can you insure your car if you are not the legal owner?

Even if you are not the legal owner, you will still be the registered keeper. It is the registered keeper's responsibility to ensure the vehicle is fully insured.

However, if you find that you are unable to make payments, you can hand the car back to the finance company as they are the legal owners.

In the event of an accident or damage, you risk invalidating your car insurance if you claim to be the owner when you're not.

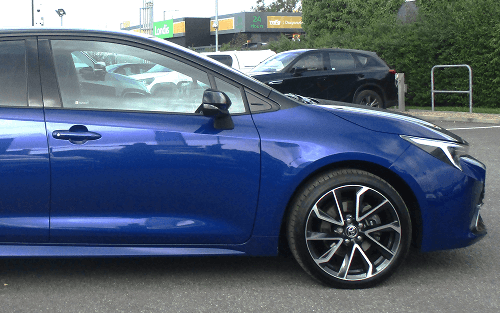

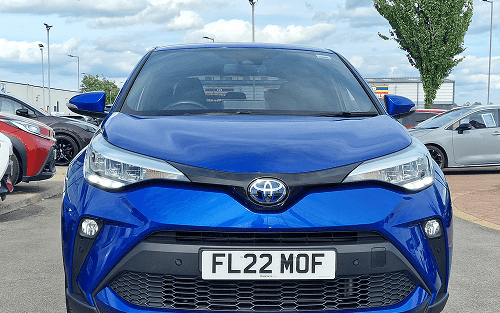

Representative Example

This represents an average of the deals that our customers receive on other vehicles

We are a credit broker and a lender. We can introduce you to a limited number of lenders and their finance products. We will provide details of products available, but no advice or recommendation will be made. You must decide whether the finance product is right for you. We do not charge you a fee for our services. Lenders will pay commission to us (either a fixed fee or a fixed percentage of the amount you borrow) for introducing you to them, this may be calculated in reference to a variable factor such as (but not limited to) the vehicle age, your credit score and the amount you are borrowing. Different lenders may pay different commissions for such introductions. Offers available to everyone over the age of 18, subject to credit approval.