PCP vs HP – Knowing the differences

When deciding on how to purchase a car, you’ll likely know that there are a few options available to you – from buying outright to getting a motor loan, but it’s car finance that is found to be the most popular choice.

But, which finance type do you choose?

The most commonly utilised types are Personal Contract Purchase (PCP) and Hire Purchase (HP). While these have many similarities, there are enough differences that it’s important to know what it is each offers you as a car buyer.

You can find out in more detail about these two finance types in our dedicated pages on PCP and HP, but here we’ll summarise the key differences.

Personal Contract Purchase vs Hire Purchase – Monthly Payments

While you pay a deposit the same way for each of the finance types (a cash sum and/or a part exchange), you will notice that when financing the same car over the same period with the same deposit, the monthly price will noticeably differ between PCP and HP.

This difference will be that the payment on the PCP quote will be distinctively cheaper than the HP equivalent.

This is because of how these payments are worked out. With HP, you pay a monthly payment until you own the car at the end of the agreement, therefore you’re paying for the full vehicle’s value.

However, with PCP, a large amount of the car’s value is tied up in what’s called the GMFV (Guaranteed Minimum Future Value), an optional payment that is paid at the end to own the car.

Because of this, the monthly payments are only paying for the difference between the total price of the car and this optional final payment. For this reason, many people choose PCP over HP and enjoy these cheaper payments over the course of the finance agreement.

PCP vs HP Finance – Limitations

It can be argued that PCP finance has the biggest possible drawbacks of the two.

The first and biggest of these is that at the start of the contract, you will need to agree to a mileage limit that must be kept to or you will incur excess mileage charges.

A mileage limit is set because this is a key factor in working out the car’s GMFV – the more miles the car does, the lower this GMFV will be and the higher the monthly payment cost, as the difference will be greater between the total value of the car and the GMFV.

Because of this, you’ll need to be fairly confident about the miles you’ll have completed when the end of the contract comes around. Having more miles on the contract than you’ll actually do only makes the monthly payments more expensive for no good reason.

Although, it must be said, finishing the contract with noticeably less mileage than agreed will help you build potential equity in the car that can be used towards your next vehicle.

You will also need to be wary about damaging the car during a PCP contract. Any damage will come at a cost at the end of the agreement. With HP, however, the lender won’t care too much about any such factors, or mileage for that matter, as you are paying to own the car.

In the case of HP, the only real limitation is that you can only pay to own the car at the end of the contract, while PCP allows you a handful of options, which we’ll get onto now.

End of contract

If you like to keep things simple in your finance agreements, then HP is probably the one for you (if you don’t mind paying a bit more a month).

As previously mentioned, you complete your monthly payments on an HP agreement until you’ve paid for the full cost of the car and the vehicle is yours. And that’s it, really.

There’s a little more to it when it comes to PCP, though, which is where the flexibility and core appeal of PCP comes into its own compared to HP.

Three key options await you upon the end of a PCP finance agreement, which are:

- Hand the car back and walk away without paying the GMFV

- Pay the GMFV (or refinance it) to make the car yours

- Use any equity in the car to part exchange it for another

Examples of PCP & HP Agreements

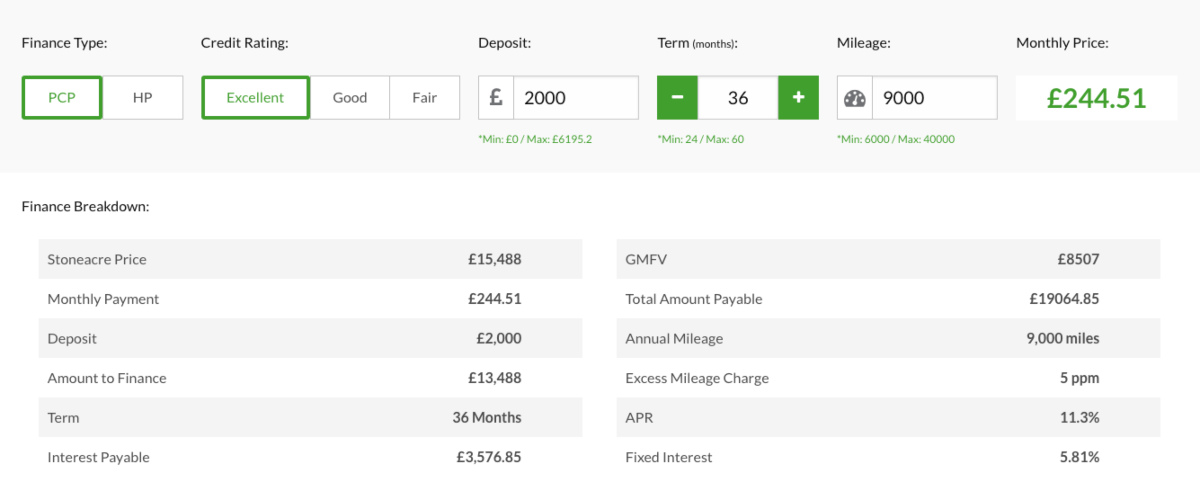

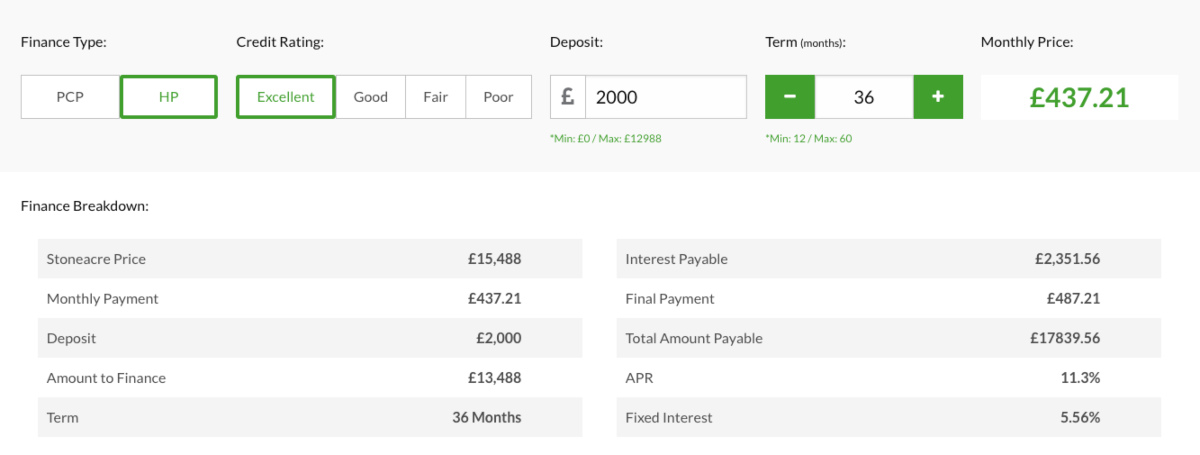

Below are two examples of each type of finance agreements so you can see the differences between PCP and HP on paper:

PCP (Ford Fiesta ST-Line – £2,000 Deposit/36-Month Term/9,000 mile PA)

HP (Ford Fiesta ST-Line – £2,000 Deposit/36-Month Term)

PCP vs HP FAQ

Is PCP finance better than buying a car?

It depends on whether you want more flexibility at the end of the contract or if buying a car right away is a priority. When purchasing a car, you’ll need a large sum upfront which could take a large chunk out of your savings account, while with PCP, you will have fixed monthly payments but not own a car at the end, unless you pay a balloon payment.

What are the differences between PCP vs HP with balloon payment?

Personal Contract Purchase has an optional balloon payment at the end of the agreement, while Hire Purchase finance doesn’t have one. This is because, with HP finance, you’ll be paying for the full value of the car, while PCP monthly payments will be lower, but have a high balloon sum which is calculated using the car’s guaranteed minimum future value.

Should I choose PCP or HP finance to fund a used car?

At Stoneacre, we have a variety of used car finance deals to suit any needs. Used cars cost less than new, and so Hire Purchase (HP) finance is a better way to fund a car than PCP, as you’ll be paying for the full value of a car and own it after the last monthly payment is made. It’s is also more common for dealers to offer HP finance rather PCP on used cars.

Representative example: £19,121.93 repayable over 48 months. 48 monthly payments of £323.72. Deposit of £1,266.23. Amount of credit £17,855.70. Representative 11.36% APR. Fixed rate per annum 6.46%. Final Payment £8,511.57. Option to purchase fee £399.00. Cost of Credit £6,194.43. Total amount payable (Incl. Deposit, charge for credit, final payment & purchase fee) is £25,715.36.

Blog Comments

To view, comment or reply to comments you must be logged into facebook